The equity market stumbled in February as the S&P 500 declined by -2.5% during the month. Despite the drop, the market is still up by +3.7% for the year due to a sprint higher in January. The S&P 500 now sits at 3,970 and remains about +12% above the 2022 closing low of 3,577 on October 12, 2022. Despite the rebound, the S&P 500 is still in bear market territory (a decline of -20% on a closing basis without a subsequent +20% increase) and now sits about -15.7% below the all-time high reached on January 3, 2022.

● Market Cap: Small (-1.7) outperformed Mid (-1.8%) and Large (-2.5%) Caps.

● Style: Growth (Russell 1000 Growth: -1.2%) exceeded Value (Russell 1000 Value: -3.5%).

● Sector: Only one of eleven sectors was positive in the month with Technology (+0.5%) as the top performer and Real Estate (-6.0%) and Energy (-7.1%) as the laggards.

Both stock and bond markets declined in February as economic data released during the month came in hotter than expected and consequently pushed interest rates and Fed tightening expectations higher. February started with the scorching January employment report showing an increase of +517,000 jobs, which was well above the consensus estimate of +189,000. In normal periods, a strong employment report would be grounds for celebration. However, the Fed is actively trying to cool the labor market to bring down inflation (specifically services inflation). In today’s environment, a strong employment report potentially means more Fed tightening and higher interest rates for longer. The trend continued as January’s inflation data released during the month, including the Consumer Price Index (CPI), Producer Price Index (PPI), and Personal Consumption Expenditures Index (PCE) reports were all higher than expected. The data pointed to an economy that is stronger than most people thought and inflation that is decelerating, but not fast enough yet. As a result, investors ratcheted up their Fed tightening forecasts. Longer-term interest rates also increased as the 10-Year Treasury went from 3.51% to 3.92% during the month. Given that FOMC expectations and interest rates increased, it was no surprise to see weakness across most asset classes.

After the market ripped higher in January, we stated we are turning more cautious in the near-term. The S&P 500 has been stuck in a trading range from 3,600 to 4,200 for nearly 10 months. Our view continues to be that inflation is the key to the market in the short term. Evidence of disinflation pushes the market toward the top end of the range, while signs that inflation will remain sticky will push the index toward the bottom. For now, our near-term market view is that we expect the S&P 500 to be rangebound a while longer. If the market were to break below this range to a new cycle low, our short-term view would turn more positive (see the next paragraph for S&P 500 returns after a significant decline). If the S&P were to break above the range and toward all-time highs, our short-term view would turn increasingly cautious. In our opinion, the fundamentals of the stock market do not support a rapid recovery back to all-time highs yet.

Over the long-term, we remain optimistic as we suspect this difficult economic and market environment over the past year has created a strong opportunity for investors willing to live with some short-term discomfort. The attached chart, Investing After Market Declines, utilizes S&P 500 month-end data from 1940 – 2021 and shows that investing when the index is down more than -10% from the all-time high has produced both strong average annualized returns and a high percentage of positive outcomes. We believe those who were able to either stay invested, rebalance, or add to their existing holdings will eventually be rewarded. Historically, equity markets have recovered from recessions and downturns; however, past performance is no guarantee of future returns. It is important to consider your own risk tolerance, financial circumstances, and time horizon.

The markets have several major events over the next month, including, Fed Chair Powell’s semiannual testimony at the Senate Banking Committee (3/7), JOLTS Job Openings Report (3/8), February Employment Report (3/10), CPI Inflation (3/14), FOMC Meeting (3/22), and PCE Inflation (3/31).

At Winthrop Wealth, we follow a Total Net Worth Approach and we believe the right mindset paired with a comprehensive financial plan and a thorough investment process can provide confidence in pursuing your long-term financial goals, especially during times of heightened market volatility. We help our clients navigate challenging markets by seeking to ensure their short-term cash flow needs are met while managing the rest of their investments in a globally diversified portfolio. By having two to three years of scheduled cash flows invested in ultra-short fixed income instruments, we seek to decrease the likelihood that we will need to sell out of risk assets after a market decline to fund distributions. Please see our recent Client Questions that can help put things into context: No strategy assures success or protects against loss.

The increase in interest rates throughout the month caused the Bloomberg Barclays US Aggregate Bond index (Agg), which acts as a proxy for the investment-grade bond market, to fall by -2.6%. The drop in February wiped out most of the Agg’s gains for 2023 as the index is now higher by about +0.4% year-to-date. The bond market (Agg) is still trying to find its footing after coming off the worst calendar year (2022: -13%) since inception of the index in 1976.

Our objective with fixed income is to provide ballast, stability, and income to portfolios. Ballast means that, ideally, the fixed income holdings are increasing when equity markets are declining. Bonds did not provide ballast for most of 2022 as interest rates rapidly increased during the first half of the year. We have continuously stated that we expect the negative correlation between stocks and bonds to return in the future once yields level out and that all else equal the fixed income markets need yields to stabilize rather than decrease to achieve positive returns. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

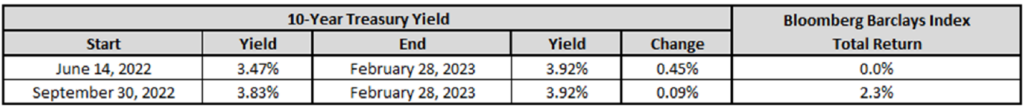

We will highlight the following time periods and note that the Bond market has been flat for nearly 9 months and positive since the beginning of Q4 2022:

The Treasury yield curve is still inverted with both the 3-Month (4.77%) and 2-Year (4.82%) higher than the 10-Year (3.92%) yield. In general, the Fed controls shorter term Treasury yields by setting the target federal funds rate while the market controls long term rates as investor demand will vary based on future expectations of inflation and economic growth. An inverted yield curve is a sign of a pessimistic economic outlook and typically signals that investors expect the Fed to cut rates soon. If the Fed does cut rates as investors expect, the 3-Month and 2-Year yields will fall below the 10-Year and the yield curve will be upward sloping again. Please see our 2019 Client Question of the Month where we provide details on a Yield Curve Inversion.

The yield to maturity of various bond indices remain at their highest levels in years. Yield to maturity is defined as the estimated annualized rate of return an investor can expect on a bond if purchased today and held to maturity, assuming the issuer makes all their interest and principal payments (i.e., no defaults). The yield to maturity on the US Aggregate Bond index increased to 4.8% at the end of the month, which is the highest level since 2009. In other words, potential future returns from the Agg bond index have not been this attractive in 14 years. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Please see our Client Question: Bond Primer where we detail bond mechanics, characteristics, types, risks, and historical returns.

Monetary Policy

The latest FOMC meeting took place from January 31st to February 1st where the Fed raised the federal funds rate by 25 basis points (bps) to a target range of 4.50% to 4.75%. The 25bp hike was a downshift from 50bps in December and four consecutive 75bp rate increases from June through November last year. Over the past eleven months, the Fed has increased interest rates from near zero to their present level in one of the quickest tightening cycles in history.

One of the big takeaways from the latest meeting was that the Fed was one or two 25bp rate hikes away from completing their tightening cycle. However, facts and viewpoints surrounding the markets can change quickly. Hotter than expected inflation data released in February pushed rate hike expectations higher. The market now expects the peak federal funds rate at 5.4%, up from 4.9% last month. The FOMC will update their projections at the March 22nd meeting.

Minutes from the February meeting stated that while “almost all” participants agreed that a 25bps rate hike was appropriate, “a few” favored a 50bp increase. If economic data continues to be unfavorable, the Fed may return to 50bps rate increases as early as March. For now, a 25bps hike at the upcoming meeting is still the most likely scenario. Basis points (bps) refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in the federal funds rate.

Going forward, we expect the Fed to become more data dependent and that upcoming inflation readings will determine how much further the FOMC will increase interest rates. Inflation still remains the key to the markets in the near term.

Inflation

The increase in inflation since early-2021 was driven by supply chain bottlenecks, surging energy prices, strong consumer demand caused by a solid labor market, and massive amounts of stimulus. Although most readings have decelerated from peak levels over the past few months, inflation is still too high. The Fed has divided inflation into three buckets: goods (decelerating as supply chains normalize), housing (decelerating under rising mortgage rates but not showing up in inflation data until mid-2023), and non-housing related core services (still elevated due to the strong labor market and robust average hourly earnings).

The Fed’s latest Summary of Economic Projections show the median participant expects Core PCE Inflation to fall to 3.5% in 2023, 2.5% in 2024, and 2.1% in 2025.

🡆 Consumer Price Index (CPI): tracks the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The index does include food and energy prices.

● Latest Reading (January): 6.4%. Prior Reading (December): 6.5%.

● Peak (June 2022): 9.1%. Source: Bureau of Labor Statistics.

🡆 Core Personal Consumption Expenditure (PCE) Index: measures the prices paid by consumers for goods and services based on surveys of what businesses are selling. Core means that the index excludes food and energy prices. This is the Fed’s preferred inflation measure, which they target at an average of 2%.

● Latest Reading (January): 4.7%. Prior Reading (December): 4.6%.

● Peak (February 2022): 5.4%. Source: Bureau of Economic Analysis.

🡆 Average Hourly Earnings: tracks total hourly renumeration (in cash or in kind) paid to employees in return for work done (or paid leave). Data is from the Current Employment Statistics (CES) survey.

● Latest Reading (January): 4.4%. Prior Reading (December): 4.8%.

● Peak (April 2020): 8.0%. Source: Bureau of Labor Statistics.

Economic Data

The United State economy is meandering along and sending several mixed signals about the future path. Over the past several weeks manufacturing data, economic indicators, consumer spending, and the housing market have all weakened while inflation has decelerated but remains above the Fed’s 2% target. It’s not hard to see signs of a recession in these areas.

Meanwhile, the strength of the economy currently lies with the labor market as the unemployment rate of 3.4% just reached its lowest level since 1968 and according to the BLS Job Openings report there are still over 11 million vacancies. While several major companies, especially in the technology sector, have announced hiring freezes or layoffs in recent months, the service sector, including retail, restaurants, hospitality, and health care, continue to add employees and search for new workers. With the Fed actively trying to soften the labor market to bring down inflation by lowering the overall demand for goods and services, we expect the unemployment rate to tick up over the next few months.

Most predictions about an imminent recession have been pushed back several months due to the ongoing strength in the labor market. The agency charged with maintaining official records of expansions and recessions, the National Bureau of Economic Research (NBER) Business Cycle Dating Committee, has stated the current period does not meet their definition of a recession as a significant decline in economic activity. According to the Federal Reserve, the possibility of a recession sometime this year is “plausible.”

The economy can potentially avoid an official recession if inflation quickly moderates over the next several months. This would take pressure off the Fed from continuing to aggressively tighten monetary policy. In our opinion, a mild recession is likely inevitable, and it does not really matter when the official start date is. Our view is still that the potential recession would be far less severe than previous economic declines like the Global Financial Crisis of 2007 – 2009.

February 2023 Market Returns

DISCLOSURES

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indexes mentioned are unmanaged indexes which cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P Midcap 400 Stock Index is an unmanaged index generally representative of the market for the stocks of mid-sized US companies.

The Russell 2000 Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell 3000 index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

The prices of small cap stocks and mid cap stocks are generally more volatile than large cap stocks.

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI EAFE Index consists of the following developed country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the UK.

The MSCI EM (Emerging Markets) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the emerging market countries of the Americas, Europe, the Middle East, Africa and Asia. The MSCI EM Index consists of the following emerging market country indices: Brazil, Chile, Colombia, Mexico, Peru, Czech Republic, Egypt, Greece, Hungary, Poland, Qatar, Russia, South Africa. Turkey, United Arab Emirates, China, India, Indonesia, Korea, Malaysia, Philippines, Taiwan, and Thailand.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

The Barclays Capital US Corporate High Yield Bond index is an index representative of the universe of fixed-rate, non-investment grade debt.

The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The Bloomberg Barclays US Treasury Bills 1-3 Month Index is designed to measure the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to 1 month and less than 3 months. The Index includes all publicly issued zero coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and at least 1 month, are rated investment grade, and have $300 million or more of outstanding face value.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Bloomberg Commodity Total Return index is composed of futures contracts and reflects the returns on a fully collateralized investment in the BCOM. This combines the returns of the BCOM with the returns on cash collateral invested in 13 week (3 Month) U.S. Treasury Bills.

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

Financial planning is a tool intended to review your current financial situation, investment objectives and goals, and suggest potential planning ideas and concepts that may be of benefit. There is no guarantee that financial planning will help you reach your goals.

Asset allocation does not ensure a profit or protect against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.

Diversification does not protect against market risk. All investing involves risk which you should be prepared to bear.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through Winthrop Wealth, a Registered Investment Advisor and separate entity from LPL Financial.

< COMMENTARY

Market Commentary | March 02, 2023

February 2023 Market Recap

By Andrew Murphy, CFA

Co-Chief Investment Officer

The equity market stumbled in February as the S&P 500 declined by -2.5% during the month. Despite the drop, the market is still up by +3.7% for the year due to a sprint higher in January. The S&P 500 now sits at 3,970 and remains about +12% above the 2022 closing low of 3,577 on October 12, 2022. Despite the rebound, the S&P 500 is still in bear market territory (a decline of -20% on a closing basis without a subsequent +20% increase) and now sits about -15.7% below the all-time high reached on January 3, 2022.

● Market Cap: Small (-1.7) outperformed Mid (-1.8%) and Large (-2.5%) Caps.

● Style: Growth (Russell 1000 Growth: -1.2%) exceeded Value (Russell 1000 Value: -3.5%).

● Sector: Only one of eleven sectors was positive in the month with Technology (+0.5%) as the top performer and Real Estate (-6.0%) and Energy (-7.1%) as the laggards.

Both stock and bond markets declined in February as economic data released during the month came in hotter than expected and consequently pushed interest rates and Fed tightening expectations higher. February started with the scorching January employment report showing an increase of +517,000 jobs, which was well above the consensus estimate of +189,000. In normal periods, a strong employment report would be grounds for celebration. However, the Fed is actively trying to cool the labor market to bring down inflation (specifically services inflation). In today’s environment, a strong employment report potentially means more Fed tightening and higher interest rates for longer. The trend continued as January’s inflation data released during the month, including the Consumer Price Index (CPI), Producer Price Index (PPI), and Personal Consumption Expenditures Index (PCE) reports were all higher than expected. The data pointed to an economy that is stronger than most people thought and inflation that is decelerating, but not fast enough yet. As a result, investors ratcheted up their Fed tightening forecasts. Longer-term interest rates also increased as the 10-Year Treasury went from 3.51% to 3.92% during the month. Given that FOMC expectations and interest rates increased, it was no surprise to see weakness across most asset classes.

After the market ripped higher in January, we stated we are turning more cautious in the near-term. The S&P 500 has been stuck in a trading range from 3,600 to 4,200 for nearly 10 months. Our view continues to be that inflation is the key to the market in the short term. Evidence of disinflation pushes the market toward the top end of the range, while signs that inflation will remain sticky will push the index toward the bottom. For now, our near-term market view is that we expect the S&P 500 to be rangebound a while longer. If the market were to break below this range to a new cycle low, our short-term view would turn more positive (see the next paragraph for S&P 500 returns after a significant decline). If the S&P were to break above the range and toward all-time highs, our short-term view would turn increasingly cautious. In our opinion, the fundamentals of the stock market do not support a rapid recovery back to all-time highs yet.

Over the long-term, we remain optimistic as we suspect this difficult economic and market environment over the past year has created a strong opportunity for investors willing to live with some short-term discomfort. The attached chart, Investing After Market Declines, utilizes S&P 500 month-end data from 1940 – 2021 and shows that investing when the index is down more than -10% from the all-time high has produced both strong average annualized returns and a high percentage of positive outcomes. We believe those who were able to either stay invested, rebalance, or add to their existing holdings will eventually be rewarded. Historically, equity markets have recovered from recessions and downturns; however, past performance is no guarantee of future returns. It is important to consider your own risk tolerance, financial circumstances, and time horizon.

The markets have several major events over the next month, including, Fed Chair Powell’s semiannual testimony at the Senate Banking Committee (3/7), JOLTS Job Openings Report (3/8), February Employment Report (3/10), CPI Inflation (3/14), FOMC Meeting (3/22), and PCE Inflation (3/31).

At Winthrop Wealth, we follow a Total Net Worth Approach and we believe the right mindset paired with a comprehensive financial plan and a thorough investment process can provide confidence in pursuing your long-term financial goals, especially during times of heightened market volatility. We help our clients navigate challenging markets by seeking to ensure their short-term cash flow needs are met while managing the rest of their investments in a globally diversified portfolio. By having two to three years of scheduled cash flows invested in ultra-short fixed income instruments, we seek to decrease the likelihood that we will need to sell out of risk assets after a market decline to fund distributions. Please see our recent Client Questions that can help put things into context: No strategy assures success or protects against loss.

● Framework for Navigating Current Conditions

● Market Timing Does Not Work

● Our Favorite Charts of 2022

● Bond Primer

Fixed Income Market

The increase in interest rates throughout the month caused the Bloomberg Barclays US Aggregate Bond index (Agg), which acts as a proxy for the investment-grade bond market, to fall by -2.6%. The drop in February wiped out most of the Agg’s gains for 2023 as the index is now higher by about +0.4% year-to-date. The bond market (Agg) is still trying to find its footing after coming off the worst calendar year (2022: -13%) since inception of the index in 1976.

Our objective with fixed income is to provide ballast, stability, and income to portfolios. Ballast means that, ideally, the fixed income holdings are increasing when equity markets are declining. Bonds did not provide ballast for most of 2022 as interest rates rapidly increased during the first half of the year. We have continuously stated that we expect the negative correlation between stocks and bonds to return in the future once yields level out and that all else equal the fixed income markets need yields to stabilize rather than decrease to achieve positive returns. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

We will highlight the following time periods and note that the Bond market has been flat for nearly 9 months and positive since the beginning of Q4 2022:

The Treasury yield curve is still inverted with both the 3-Month (4.77%) and 2-Year (4.82%) higher than the 10-Year (3.92%) yield. In general, the Fed controls shorter term Treasury yields by setting the target federal funds rate while the market controls long term rates as investor demand will vary based on future expectations of inflation and economic growth. An inverted yield curve is a sign of a pessimistic economic outlook and typically signals that investors expect the Fed to cut rates soon. If the Fed does cut rates as investors expect, the 3-Month and 2-Year yields will fall below the 10-Year and the yield curve will be upward sloping again. Please see our 2019 Client Question of the Month where we provide details on a Yield Curve Inversion.

The yield to maturity of various bond indices remain at their highest levels in years. Yield to maturity is defined as the estimated annualized rate of return an investor can expect on a bond if purchased today and held to maturity, assuming the issuer makes all their interest and principal payments (i.e., no defaults). The yield to maturity on the US Aggregate Bond index increased to 4.8% at the end of the month, which is the highest level since 2009. In other words, potential future returns from the Agg bond index have not been this attractive in 14 years. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

Please see our Client Question: Bond Primer where we detail bond mechanics, characteristics, types, risks, and historical returns.

Monetary Policy

The latest FOMC meeting took place from January 31st to February 1st where the Fed raised the federal funds rate by 25 basis points (bps) to a target range of 4.50% to 4.75%. The 25bp hike was a downshift from 50bps in December and four consecutive 75bp rate increases from June through November last year. Over the past eleven months, the Fed has increased interest rates from near zero to their present level in one of the quickest tightening cycles in history.

One of the big takeaways from the latest meeting was that the Fed was one or two 25bp rate hikes away from completing their tightening cycle. However, facts and viewpoints surrounding the markets can change quickly. Hotter than expected inflation data released in February pushed rate hike expectations higher. The market now expects the peak federal funds rate at 5.4%, up from 4.9% last month. The FOMC will update their projections at the March 22nd meeting.

Minutes from the February meeting stated that while “almost all” participants agreed that a 25bps rate hike was appropriate, “a few” favored a 50bp increase. If economic data continues to be unfavorable, the Fed may return to 50bps rate increases as early as March. For now, a 25bps hike at the upcoming meeting is still the most likely scenario. Basis points (bps) refers to a common unit of measure for interest rates and other percentages in finance. One basis point is equal to 1/100th of 1%, or 0.01%, or 0.0001, and is used to denote the percentage change in the federal funds rate.

Going forward, we expect the Fed to become more data dependent and that upcoming inflation readings will determine how much further the FOMC will increase interest rates. Inflation still remains the key to the markets in the near term.

Inflation

The increase in inflation since early-2021 was driven by supply chain bottlenecks, surging energy prices, strong consumer demand caused by a solid labor market, and massive amounts of stimulus. Although most readings have decelerated from peak levels over the past few months, inflation is still too high. The Fed has divided inflation into three buckets: goods (decelerating as supply chains normalize), housing (decelerating under rising mortgage rates but not showing up in inflation data until mid-2023), and non-housing related core services (still elevated due to the strong labor market and robust average hourly earnings).

The Fed’s latest Summary of Economic Projections show the median participant expects Core PCE Inflation to fall to 3.5% in 2023, 2.5% in 2024, and 2.1% in 2025.

🡆 Consumer Price Index (CPI): tracks the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services. The index does include food and energy prices.

● Latest Reading (January): 6.4%. Prior Reading (December): 6.5%.

● Peak (June 2022): 9.1%. Source: Bureau of Labor Statistics.

🡆 Core Personal Consumption Expenditure (PCE) Index: measures the prices paid by consumers for goods and services based on surveys of what businesses are selling. Core means that the index excludes food and energy prices. This is the Fed’s preferred inflation measure, which they target at an average of 2%.

● Latest Reading (January): 4.7%. Prior Reading (December): 4.6%.

● Peak (February 2022): 5.4%. Source: Bureau of Economic Analysis.

🡆 Average Hourly Earnings: tracks total hourly renumeration (in cash or in kind) paid to employees in return for work done (or paid leave). Data is from the Current Employment Statistics (CES) survey.

● Latest Reading (January): 4.4%. Prior Reading (December): 4.8%.

● Peak (April 2020): 8.0%. Source: Bureau of Labor Statistics.

Economic Data

The United State economy is meandering along and sending several mixed signals about the future path. Over the past several weeks manufacturing data, economic indicators, consumer spending, and the housing market have all weakened while inflation has decelerated but remains above the Fed’s 2% target. It’s not hard to see signs of a recession in these areas.

Meanwhile, the strength of the economy currently lies with the labor market as the unemployment rate of 3.4% just reached its lowest level since 1968 and according to the BLS Job Openings report there are still over 11 million vacancies. While several major companies, especially in the technology sector, have announced hiring freezes or layoffs in recent months, the service sector, including retail, restaurants, hospitality, and health care, continue to add employees and search for new workers. With the Fed actively trying to soften the labor market to bring down inflation by lowering the overall demand for goods and services, we expect the unemployment rate to tick up over the next few months.

Most predictions about an imminent recession have been pushed back several months due to the ongoing strength in the labor market. The agency charged with maintaining official records of expansions and recessions, the National Bureau of Economic Research (NBER) Business Cycle Dating Committee, has stated the current period does not meet their definition of a recession as a significant decline in economic activity. According to the Federal Reserve, the possibility of a recession sometime this year is “plausible.”

The economy can potentially avoid an official recession if inflation quickly moderates over the next several months. This would take pressure off the Fed from continuing to aggressively tighten monetary policy. In our opinion, a mild recession is likely inevitable, and it does not really matter when the official start date is. Our view is still that the potential recession would be far less severe than previous economic declines like the Global Financial Crisis of 2007 – 2009.

February 2023 Market Returns

DISCLOSURES

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

All indexes mentioned are unmanaged indexes which cannot be invested into directly. Unmanaged index returns do not reflect fees, expenses, or sales charges. Index performance is not indicative of the performance of any investment. Past performance is no guarantee of future results.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

The S&P Midcap 400 Stock Index is an unmanaged index generally representative of the market for the stocks of mid-sized US companies.

The Russell 2000 Index is an unmanaged index generally representative of the 2,000 smallest companies in the Russell 3000 index, which represents approximately 10% of the total market capitalization of the Russell 3000 Index.

The prices of small cap stocks and mid cap stocks are generally more volatile than large cap stocks.

The MSCI EAFE Index is a free float-adjusted market capitalization index that is designed to measure the equity market performance of developed markets, excluding the US & Canada. The MSCI EAFE Index consists of the following developed country indices: Australia, Austria, Belgium, Denmark, Finland, France, Germany, Hong Kong, Ireland, Israel, Italy, Japan, the Netherlands, New Zealand, Norway, Portugal, Singapore, Spain, Sweden, Switzerland and the UK.

The MSCI EM (Emerging Markets) Index is a free float-adjusted market capitalization weighted index that is designed to measure the equity market performance of the emerging market countries of the Americas, Europe, the Middle East, Africa and Asia. The MSCI EM Index consists of the following emerging market country indices: Brazil, Chile, Colombia, Mexico, Peru, Czech Republic, Egypt, Greece, Hungary, Poland, Qatar, Russia, South Africa. Turkey, United Arab Emirates, China, India, Indonesia, Korea, Malaysia, Philippines, Taiwan, and Thailand.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

The Barclays Capital US Corporate High Yield Bond index is an index representative of the universe of fixed-rate, non-investment grade debt.

The Bloomberg Barclays U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

The Bloomberg Barclays US Treasury Bills 1-3 Month Index is designed to measure the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to 1 month and less than 3 months. The Index includes all publicly issued zero coupon U.S. Treasury Bills that have a remaining maturity of less than 3 months and at least 1 month, are rated investment grade, and have $300 million or more of outstanding face value.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.

The Bloomberg Commodity Total Return index is composed of futures contracts and reflects the returns on a fully collateralized investment in the BCOM. This combines the returns of the BCOM with the returns on cash collateral invested in 13 week (3 Month) U.S. Treasury Bills.

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

Financial planning is a tool intended to review your current financial situation, investment objectives and goals, and suggest potential planning ideas and concepts that may be of benefit. There is no guarantee that financial planning will help you reach your goals.

Asset allocation does not ensure a profit or protect against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio.

Diversification does not protect against market risk. All investing involves risk which you should be prepared to bear.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through Winthrop Wealth, a Registered Investment Advisor and separate entity from LPL Financial.